Raw Material Market Update — January 5, 2026

In the context of today’s rapidly evolving global economy, access to accurate and timely market intelligence has become a critical factor for business success.

Tai Hing remains dedicated to delivering professional insights and strategic information to help clients make informed procurement decisions and achieve mutually beneficial outcomes.

Presented below is our latest summary of recent raw material price movements, intended to support our clients’ operational and procurement planning.

(All prices are quoted on an ex-factory, tax-exclusive basis.)

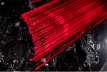

PA6

Price Movement:

From December 2025 to early January 2026, PA6 prices have demonstrated a “rebound followed by stabilization at higher levels” trend. Market fluctuations were minimal, indicating a period of consolidation after a sustained recovery phase.

Outlook:

Over the short term, PA6 prices are expected to remain in a high-level consolidation range with limited volatility. Medium- to long-term performance will depend on the pace of downstream demand recovery after the Lunar New Year.

We recommend that industry participants maintain cautious optimism, remain agile in procurement planning, and consider pre-holiday stocking ahead of potential price rebounds.

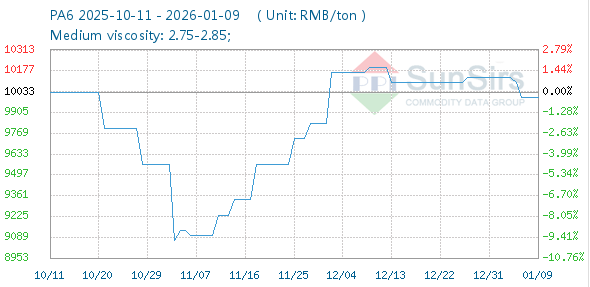

PA66

Price Movement:

PA66 prices exhibited a “bottoming-out and low-level stabilization” pattern during the same period. Downward pressure has largely been digested, and the market is currently in a weak consolidation stage with no significant upward momentum.

Outlook:

In the near term, PA66 is likely to remain range-bound under mild weakness, while medium-term trends depend heavily on downstream demand recovery post-holiday.

We advise clients to closely monitor raw material cost drivers, market sentiment, and demand-side developments. Procurement strategies should remain flexible—adopting a “wait-and-see” posture or buying on dips as appropriate in response to cost fluctuations.

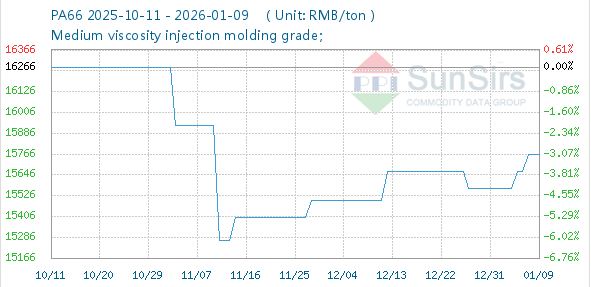

PBT

Price Movement:

PBT prices have remained exceptionally stable with a marginal upward bias throughout December 2025 and early January 2026. The cumulative change was below 0.5%, effectively indicating price stability and market balance.

Outlook:

Short-term price movement is expected to stay flat to slightly firm, with minimal volatility. Over the medium term, attention should be directed to downstream demand recovery following the holiday period.

Clients are encouraged to adopt a stable and risk-controlled procurement approach, continuously tracking feedstock costs, supply-demand dynamics, industry competitiveness, and policy shifts to support timely adjustments in sourcing and forecasting strategies.

PET

Price Movement:

PET prices exhibited a “sharp rebound following a low-level fluctuation” phase from December 2025 to early January 2026, achieving an approximate increase of 6.35% during the period.

Outlook:

The rebound in PET prices was primarily supported by rising crude oil prices and downstream restocking activities. In the short term, high-level consolidation is anticipated, while medium-term performance will hinge on energy market trends and the strength of post-holiday consumption recovery.

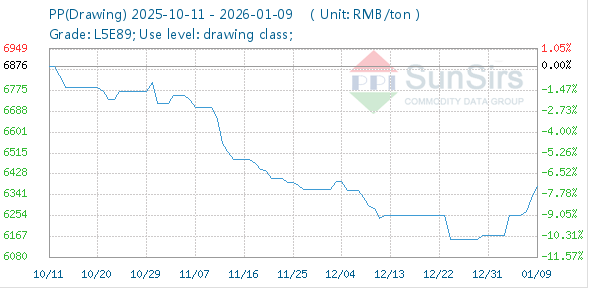

PP

Price Movement:

During the review period, PP prices displayed a “continued downtrend with marginal recovery” pattern. Early January saw a modest rebound driven by limited downstream replenishment, though the overall market remains in a late-stage correction phase.

Outlook:

PP market performance is expected to feature narrow-range fluctuations in the short term. Given ongoing global geopolitical uncertainties and recent surges in crude oil prices, the potential for a sharper rebound in PP cannot be ruled out.

Over the medium term, traders and manufacturers should monitor energy costs and seasonal demand resumption as key influences on future price direction.

Conclusion

At Tai Hing, we recognize that reliable market intelligence is fundamental to effective procurement and strategic decision-making. We are committed to providing transparent, data-driven, and actionable market updates to help our clients navigate volatility with confidence.

Through our regular raw material pricing insights, we aim to enable clients to plan procurement schedules strategically, optimize cost efficiency, and strengthen competitive positioning.

Guided by our core philosophy of “Customer First, Creating Shared Value,” Tai Hing continues to foster long-term, trust-based partnerships and deliver high-value market perspectives that drive sustainable business success.

For comprehensive data access or customized consultation, please feel free to contact us. Email:marketing2@taihingnylon.com