Recent Raw Material Price Update (August 2025)

In today's rapidly changing global economy, accurate market information is key to a company's success. Tai Hing Nylon Filament Products Co., Ltd. is committed to providing customers with professional market insights, helping them make procurement decisions at the right time to achieve win-win outcomes. Below is a summary of recent raw material price fluctuations for your business reference. (All prices listed are ex-factory prices excluding taxes.)

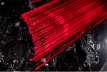

PA6 (Nylon 6)

Price Movement: As shown in the chart, PA6 prices trended downward in July but rose in early August, with an overall increase of approximately 1.6%.

Future Trend: In the short term, the slight rebound in early August may continue if supported by improved downstream orders and rising upstream raw material prices.

For the medium to long term, caution is needed regarding the supply-demand balance. Without strong positive drivers, weak fluctuations or a downward trend are likely, depending on inflection points in macroeconomic and industrial fundamentals.

It is recommended that industry participants maintain cautious optimism, respond flexibly to market changes, and stock up proactively before prices rise.

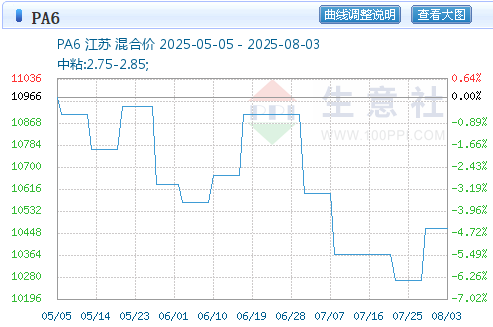

PA66 (Nylon 66)

Price Movement: PA66 prices were relatively stable in early July, declined in mid-July, and stabilized from late July to early August.

Future Trend: Currently, prices are stabilizing at a low level. In the short term, without significant changes in supply-demand or costs, prices may fluctuate within a low range.

For the medium to long term, track raw materials, downstream operating rates, and industry policies for new drivers.

Customers are advised to closely monitor cost changes, market dynamics, and demand factors, adjust procurement and sales strategies flexibly, and adopt a wait-and-see approach or low-price procurement based on actual needs.

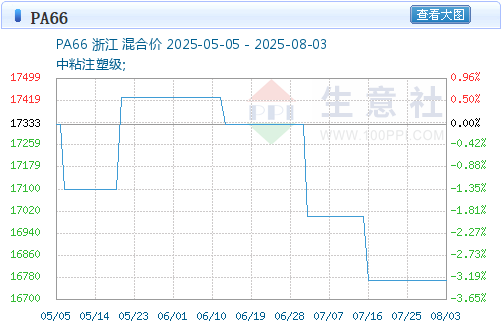

PBT

Price Movement: PBT prices remained stable from late July to early August, with little overall change.

Future Trend: In the short term, prices will stay relatively stable.

For the medium to long term, focus on upstream raw material prices, crude oil prices, downstream demand, industry production capacity, and operating rates for new driving factors.

Customers are advised to maintain caution, closely monitor market dynamics, raw material price trends, supply-demand data, industry competition patterns, and policy changes, obtain timely market demand and the latest price information, and adjust forecasts and procurement strategies as appropriate.

PET

Price Movement: PET prices gradually increased from mid-July to early August before stabilizing, with an overall cumulative increase of approximately 2.4%.

Future Trend: In the short term, social inventories continue to accumulate, intensifying supply-demand contradictions. The core lies in the dynamic balance between costs and supply-demand.

July's price trend will still be highly dependent on crude oil performance. It is recommended to closely monitor macro events such as OPEC+ meetings and the Federal Reserve's interest rate decisions, as well as inventory changes in the industrial chain.

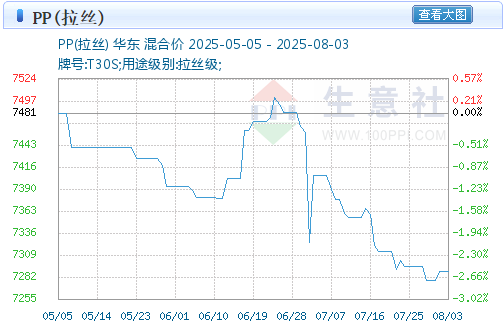

PP

Price Movement: PP prices showed an overall downward trend in July but showed signs of a slight rebound from late July to early August.

Future Trend: In the short term (within August), prices may continue to fluctuate slightly or rise further.

If there are positive signals such as cost support and demand recovery, phased rebound opportunities may emerge.

It is recommended to closely monitor international oil price trends, cost changes, and downstream procurement rhythms for PP.

We understand that reliable information supports corporate procurement. Tai Hing will continue to provide transparent and accurate market dynamics, helping you plan procurement strategies rationally for higher cost-effectiveness.

Adhering to the philosophy of "Customer First, Co-Creating Value", Tai Hing is committed to building long-term, trust-based partnerships with customers. We will continue to provide valuable market insights to support your business growth.

For further market data or professional advice, please contact us anytime. Email: marketing2@taihingnylon.com

The above content is for reference only. Data sources:

- Shengyishe:

- Ansou Plastic Network:

- Crude Oil Market Trends:

https://www.tnc.com.cn/market/average-price-d147.html