Recent Raw Material Price Update (Nov 8, 2025)

In today’s rapidly changing global economy, access to accurate market information is key to business success. Tai Hing is committed to providing clients with timely and professional market insights, enabling smart purchasing decisions and mutual growth. Below is a summary of recent raw material price fluctuations, intended to support your business planning. (All prices are ex-factory, excluding tax.)

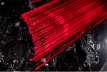

PA6 (Nylon 6)

Price trend: Prices declined steadily through late October, with a total drop of 7.2%, followed by a mild 1.35% rebound in early November.

Outlook: After the previous drop, short-term stabilization is likely. Without strong recovery in downstream demand or support from upstream costs, prices are expected to remain in a narrow range this month. Medium- to long-term prices will depend on feedstock costs and supply-demand balance. We recommend a cautiously optimistic approach — monitor market signals closely and consider proactive stocking before possible rebounds.

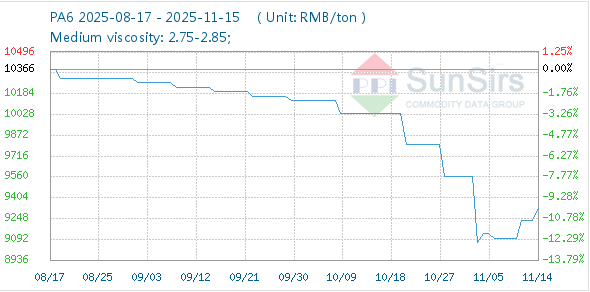

PA66 (Nylon 66)

Price trend: Prices experienced a modest 1.8% decline through October, then stabilized in early November.

Outlook: The market has formed short-term support around current levels, showing weak but steady balance between supply and demand. Unless major changes occur in cost or demand, prices will likely fluctuate slightly around current levels. Monitor feedstock trends and downstream production to refine procurement strategies — consider buying on dips when suitable.

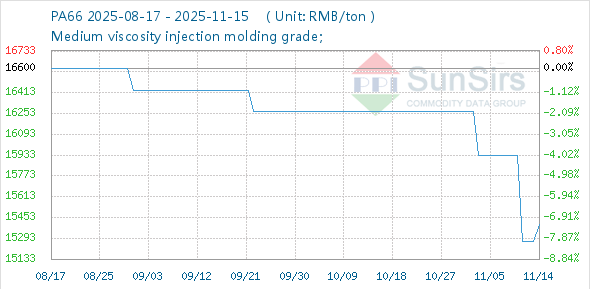

PBT

Price trend: PBT prices showed two small declines from October to early November, with a cumulative 2.6% drop, then entered a stable phase.

Outlook: As long as upstream feedstock prices and downstream demand remain stable, PBT prices are expected to stay firm with minor fluctuations. Further decline momentum is weak. Medium-term movements will depend on shifts in supply-demand and raw material costs. We suggest maintaining a steady and cautious stance while tracking market dynamics closely for timely adjustments in purchasing strategies.

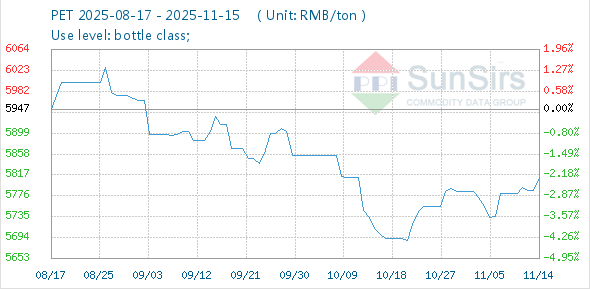

PET

Price trend: PET prices went through several fluctuations — a decline, rebound, and another soft correction in October — and began a slight upward trend in early November.

Outlook: For November, PET is expected to remain range-bound with limited upside potential. In the short term, supply-demand and feedstock price movements will dominate. Over the mid-term, prices will likely oscillate near bottom levels, depending on crude oil trends and downstream consumption.

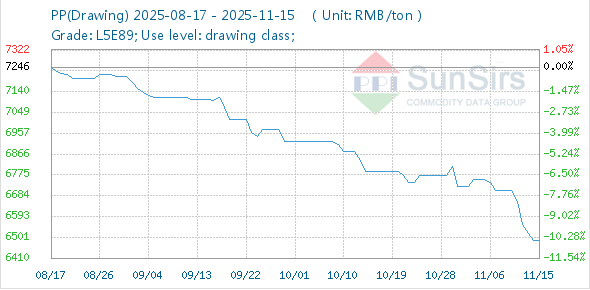

PP (Polypropylene)

Price trend: Affected by weaker crude prices in October and gradual stabilization in early November, PP prices fell by around 2.6% before leveling off.

Outlook: October to early November saw a downward trend impacted by both crude oil weakness and supply pressure. Should global crude prices strengthen due to output cuts or demand recovery, PP could find firm cost support and stabilize. Overall, prices are expected to remain in a bottoming consolidation pattern in the near term.

Tai Hing understands that purchasing decisions rely on reliable insight. We will continue providing transparent and data-driven market updates to help our clients plan purchases effectively and control costs.

Our guiding principle, “Customer First, Creating Value Together,” reflects our commitment to building lasting partnerships based on trust and shared success. Looking ahead, we’ll continue to provide actionable market insights to help drive your growth and long-term profitability.