Recent Raw Material Price Update (2025-10-09)

In today’s rapidly changing global economy, having accurate, timely market intelligence is key to business success. Tai Hing is committed to providing clients with professional insights to help them make well-timed purchasing decisions and achieve win-win outcomes.

Below is our summary of recent raw material price movements for your reference. (All prices cited are ex-factory, tax excluded.)

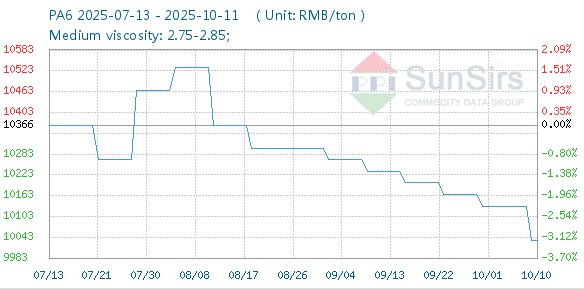

PA6 (Nylon 6)

- Price movement: Charts indicate that PA6 prices dipped slightly from September to early October, then stabilized, for a cumulative decline of 1.4%.

- Outlook: In the near term, prices will likely fluctuate in a narrow range through October. As factories ramp up after the National Day holiday, a rebound is possible. For the medium to long term, closely monitor plant operating rates, supply-demand dynamics, and marginal cost changes. If supply-demand imbalances persist, softness may continue. We recommend cautious optimism, flexible tactics, and proactive stocking ahead of price turns.

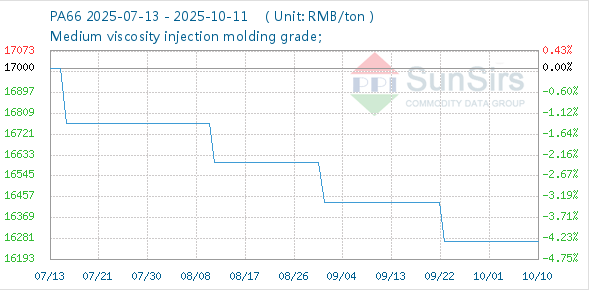

PA66 (Nylon 66)

- Price movement: From September to October, PA66 saw a modest decline followed by stabilization, with a cumulative drop of 0.7%.

- Outlook: From late September into October, the market entered a more stable phase. With post-holiday production resuming, prices may rebound. Absent major shifts in supply-demand or costs, prices could see mild range-bound volatility in the short term. Over the medium to long term, track feedstock trends, downstream operating rates, and policy factors for new drivers. We suggest closely monitoring the cost side, market dynamics, and demand signals, and adjusting buy/sell strategies accordingly—either wait-and-see or buy on dips based on actual needs.

PBT

- Price movement: PBT prices were broadly steady through September with minimal overall change.

- Outlook: Short term, prices appear relatively stable. For the medium to long term, watch upstream feedstock prices, crude oil, downstream demand, industry capacity, and utilization for new catalysts. We advise a cautious, stability-focused approach: monitor market developments, raw material trends, supply-demand data, competitive landscape, and policy changes to capture timely demand and pricing information and adjust forecasts and procurement strategies as needed.

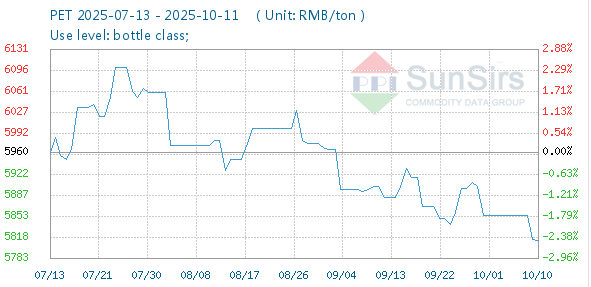

PET

- Price movement: PET experienced multiple swings in September, then stabilized during the October National Day period. The cumulative decline was 0.8%, with limited overall change.

- Outlook: Short term, the market reflects a tug-of-war between demand and feedstock costs. Medium term, prices will be influenced by costs, demand, and capacity. Long term, industry supply-demand balance will be decisive. PET remains highly correlated with crude oil; we recommend closely watching OPEC+ meetings, Federal Reserve rate decisions, and inventory changes across the value chain.

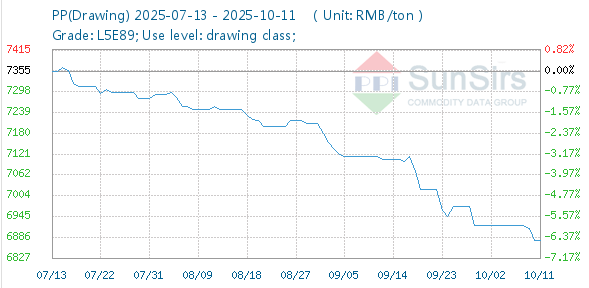

PP (Polypropylene)

- Price movement: With crude oil fluctuating in September, PP likewise showed wide, alternating moves before stabilizing during the early-October holiday period.

- Outlook: In October, PP may continue mild range-bound trading, with potential for a rebound as plants resume post-holiday. Medium to long term, keep an eye on upstream feedstocks, downstream demand, and macro policy shifts. PP’s trajectory will track crude oil costs closely. We recommend monitoring international oil prices, cost-side changes, unexpected events, and the purchasing cadence of PP downstream sectors to inform timely decisions.

We understand that reliable information is essential for procurement. Tai Hing will continue to deliver transparent and accurate market updates, partnering with you to navigate change. Through regular sharing of raw material price insights, we aim to help you plan purchases prudently and enhance cost efficiency.

Guided by our “Customer First, Co-creating Value” philosophy, Tai Hing is committed to long-term, trusted partnerships. We will keep providing actionable market intelligence to support your business growth.

For further data or tailored advice, please contact us anytime. Let’s work together for mutual success. Email: marketing2@taihingnylon.com

Disclaimer: For reference only. Data sources include “Sunsirs” and “Antsoo Plastics.”

- Sunsirs: https://www.100ppi.com/ppi/

- Antsoo Plastics: https://www.antsoo.com/quotation?Material=PBT&MaterialId=14&MaterialCategoryType=0"ationPriceContNum=0&MaterialContMPriceChange=0

- Crude Oil Market: https://www.tnc.com.cn/market/average-price-d147.html