Recent Raw Material Price Update (2025-09-03)

In today’s rapidly changing global economy, having accurate market intelligence is key to business success. Tai Hing is committed to providing clients with professional insights to help them make timely purchasing decisions and achieve win-win outcomes. Below is our summary of recent raw material price movements for your reference. (All prices are ex-works, VAT excluded.)

PA6 (Nylon 6)

Price movements: The chart indicates PA6 prices rose in early August, then pulled back, and remained relatively stable in late August.

Outlook: In the short term, prices are likely to fluctuate around current levels if no major shocks occur in September.

Over the medium to long term, watch for changes in supply-demand dynamics, cost movements, producer cutbacks, and downstream purchasing, which could stabilize prices or even trigger a rebound.

We recommend a cautiously optimistic stance and flexible responses, with proactive stocking ahead of potential moves.

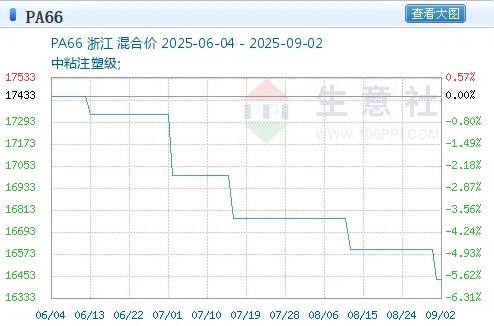

PA66 (Nylon 66)

Price movements: PA66 edged down slightly in early August before stabilizing. A small dip is expected in early September, with a cumulative decline of about 0.65%.

Outlook: The market appears to be stabilizing. In the near term, absent major shifts in supply, demand, or cost, prices may see modest range-bound fluctuations.

For the medium to long term, track feedstock prices, downstream operating rates, and policy developments for new catalysts.

We suggest closely monitoring cost-side changes and market dynamics, flexibly adjusting buying and sales strategies, and adopting a wait-and-see or buy-the-dip approach based on actual needs.

PBT

Price movements: PBT saw a mild downtrend in early August, followed by small swings mid-to-late August, and has since flattened out. Overall, early September shows little change versus August.

Outlook: Prices look steady in the short term, influenced by crude oil trends and supply-demand conditions.

For the medium to long term, keep a close eye on upstream feedstock prices, crude oil, downstream demand, and capacity developments.

We recommend a cautious, steady approach: monitor market moves, raw material trends, supply-demand data, competitive dynamics, and policy changes; capture demand signals and the latest pricing in time; and adjust forecasts and procurement strategies as needed.

PET

Price movements: PET prices were broadly stable from August into early September, oscillating within a narrow range without large swings.

Outlook: Near-term prices hinge on the tug-of-war between demand and feedstock costs;

Medium-term trends will be shaped by costs, demand, and capacity;

Longer term will depend on the evolution of industry supply-demand. PET remains highly correlated with crude oil performance.

We recommend closely watching macro events such as OPEC+ meetings and Federal Reserve rate decisions, as well as inventory cycle changes across the value chain.

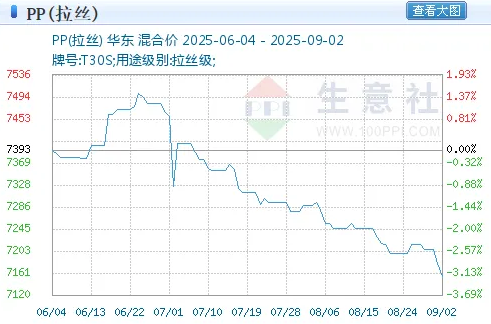

PP

Price movements: With crude oil volatile in August, PP also experienced wide two-way swings with no major net change. As crude rebounded from late August into early September, PP is likely to dip slightly first in September, then swing and rebound.

Outlook: In September, prices may continue mild choppy trading or move further. For the medium to long term, monitor upstream feedstocks, downstream demand, and macro policies. PP trends will closely track crude cost fluctuations.

We advise watching global oil prices, cost-side shifts, unforeseen events, and downstream buying rhythms, and continuously tracking market dynamics to refine judgments.

We understand that reliable information is essential for procurement. Tai Hing will continue to deliver transparent and accurate market updates and work with you to navigate market changes. Through regular updates on raw material prices, we aim to help you plan purchases more effectively and enhance cost efficiency.

Upholding our “Customer First, Co-creating Value” philosophy, Tai Hing is dedicated to long-term, trust-based partnerships. We will keep providing valuable market insights to support your business growth.

For further market data or professional advice, please contact us anytime. Let’s achieve success together.

Disclaimer and sources are for reference only.

Data sourced from:

ICIS-like China platform “100PPI” (Business Community): https://www.100ppi.com/ppi/

Antsoo Plastics:

Crude oil market trends: https://www.tnc.com.cn/market/average-price-d147.html