Recent Raw Material Price Analysis (2025-06-03)

In today's rapidly changing global economy, accurate market information has become crucial for corporate success. Tai Hing Nylon Filament Products Co., Ltd. is committed to providing professional market insights to help clients make procurement decisions at the right time and achieve win-win outcomes. Below is an analysis of recent raw material price fluctuations for your reference. (All prices are ex-factory prices without tax.)

PA6 (Nylon 6)

Price Trend: From the chart, PA6 prices rose first and then fell from May to June, with an overall decline of approximately 1.78%.

Future Outlook: The decline accelerated in late May to early June, and no obvious signal of stabilization has been seen yet.

Short-term downward pressure may persist, as upstream suppliers will adjust prices moderately based on current raw material changes.

Long-term, if downstream demand continues to grow and the industry undergoes technological innovation and structural optimization, PA6 prices are expected to stabilize and rebound after adjustment.

Due to complex market dynamics and multiple influencing factors, we recommend close monitoring of supply-demand conditions, raw material prices, and policy adjustments, and adopting batch procurement as needed to avoid price volatility risks.

PA66 (Nylon 66)

Price Trend: PA66 prices fell, fluctuated at low levels, rebounded slightly, and then stabilized from May to June, with a cumulative decline approaching 1%.

Future Outlook: In the short term, prices are oscillating at low levels with weak rebound momentum, and upstream manufacturers are unlikely to make significant price adjustments. On the demand side, downstream industries (injection molding, fibers) are in a off-season, with slow demand recovery failing to boost prices.

Medium-to-long term, prices are expected to fluctuate within a bottom range, with limited rebound potential. Clients are advised to closely monitor market dynamics and demand-related factors, adjust procurement plans flexibly, and adopt a wait-and-see or low-cost procurement strategy based on actual needs.

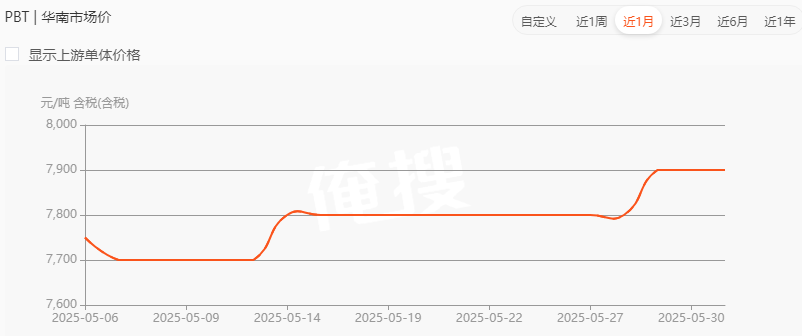

PBT

Price Trend: PBT prices experienced a slight decline (-0.65%), rebound (+1.3%), sideways movement, and then an increase (+1.28%) from May to June, with a cumulative gain of 1.94%.

Future Outlook: After a period of sideways slight increase, the price is likely to continue the current trend in the short term if no major unexpected factors alter the supply-demand fundamentals, and upstream manufacturers may slightly adjust prices according to raw material changes.

The future PBT price trend is uncertain; clients are advised to maintain a cautious attitude, stabilize inventory management, closely follow market dynamics, obtain timely demand and price updates, and adjust procurement strategies appropriately.

PET

Price Trend: PET prices rose significantly, fluctuated at high levels, and then fell slightly to stabilize from May to June, with an overall increase of approximately 4.5%.

Future Outlook: In the short term, there is an imbalance between raw material costs (PTA, MEG) and downstream demand (water bottles, fibers). If cost support and demand recovery occur, the price may trend moderately upward; otherwise, volatility may persist, driving upstream manufacturer prices to fluctuate.

Medium-to-long term, attention should be paid to market demand, production costs, environmental policies, and technological innovation. Prices may fluctuate around current levels if no major changes occur in these factors.

PP

Price Trend: PP prices showed a gradual downward trend from May to June, with a cumulative decline of approximately 1.24%.

Future Outlook: The current PP market is in a game between capacity expansion and weak demand recovery.

Short-term prices lack upward momentum, with weak supply-demand fundamentals and cost pressure, likely leading to low-level fluctuations.

Long-term, if the structural oversupply pattern persists and capacity exceeds demand, prices may continue to fluctuate at low levels or further decline.

Additionally, the rise in upstream raw materials (crude oil) in May may drive PP filament prices higher, with major manufacturers adjusting prices accordingly. Industry participants are advised to focus on risk aversion and wait for signals of supply-demand rebalancing.

We understand that reliable information is critical for corporate procurement, and we will continue to provide transparent and accurate market updates to help you navigate market changes. By regularly sharing raw material price information, we aim to assist clients in planning procurement strategies and achieving higher cost efficiency.

Tai Hing always adheres to the philosophy of "Customer First, Creating Shared Value" and is committed to building long-term trusting partnerships with clients. In the future, we will strive to provide more valuable market insights to support your business growth.

For further market data or professional advice, please feel free to contact us.

Email:marketing@taihingnylon.com

Disclaimer: The above content is for reference only.

Data sources: https://www.100ppi.com/ppi/

https://www.antsoo.com/quotation?Material=PBT&MaterialId=14&MaterialCategoryType=0"ationPriceContNum=0&MaterialContMPriceChange=0